It’s fair to say that many of us are not clued up on what to know about prenuptial agreements. Prenups have gotten a pretty bad reputation over the years. For many, the mere thought of getting a prenup is like sealing your fate to get divorced. However, the reality is a lot of issues can creep up throughout the course of a marriage.

Sure, no one wants to think about divorce when you’re planning a wedding to the love of your life, but it never hurts to be prepared. Getting a prenup is simply about protecting yourself against the worst-case scenario. In the event that your marriage breaks down, your personal or family assets will, as far as possible, be protected. Not to mention, contesting a divorce through the courts can sometimes cost thousands. So, getting a prenup might not be such a bad idea after all, and may save a lot of money and stress.

Here’s what to know about prenuptial agreements.

What does a prenuptial agreement do?

Firstly, it’s important to understand what a prenup actually does. A prenuptial agreement, also known as a prenup, is a written contract made by engaged couples before they get married. The prenup states their rights and responsibilities regarding individual and joint assets (and debts). It breaks down how these assets would be divided should the relationship, unfortunately, end in divorce.

Who should get a prenuptial agreement?

Prenups are usually ideal when one partner has or is expected to acquire, more assets than the other. For example, a prenup is likely to be put in place for those with a large inheritance, property or business owners or even couples marrying in later life who want to protect their pensions. A prenup allows couples to make more specific arrangements, as opposed to a typical 50/50 split.

Having said that, you don’t need to be rolling in money to get a prenup. At the end of the day, a prenup serves to clarify each party’s financial rights and prevent disputes regarding all marital assets.

What should be included in a prenuptial agreement?

Prenups are the perfect way to ensure you and your soon-to-be spouse are on the same page. But every prenup is different and will need to be tailored to you and your partner’s specific needs.

The prenuptial agreement should include:

- An inventory of both your assets

- Details on how these assets should be looked after during the course of your marriage

- Details on how these assets will be dealt with and divided in the event of a divorce

- Assets that you do not intend on splitting or dividing

These assets can be broken down into:

- Incomes

- Pensions

- Savings

- Property held, both solely and jointly

- Premium bonds

- Inheritance

- Stocks and shares

- Business interests

Sure, prenups can cover a myriad of assets and issues. However, that doesn’t mean your prenup will cover everything.

At the end of the day, if you want your prenup to be taken seriously in court, it’s important to think carefully about what to include and what not to include in your prenuptial agreement. Usually, it’s best not to include the below issues in a prenup:

- Personal matters

- Lifestyle matters

- Illegal or unreasonable matters

- Child support

- Child custody – this includes visitation rights, schooling and religious upbringing

Are prenups legal in the UK?

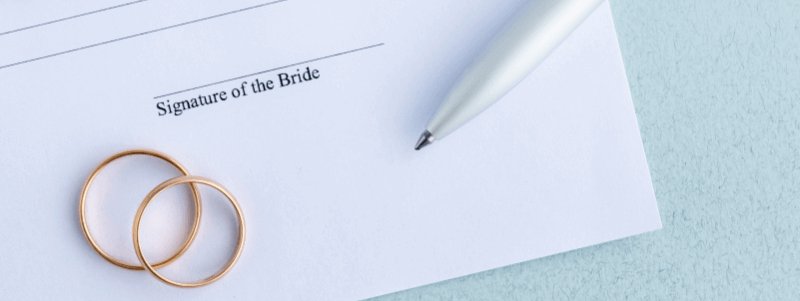

At present, prenups are not legally binding in the UK. However, courts still recognise prenups and they may be held up in court providing the agreement is fair and does not discriminate against any children.

To hold significant weight in court, it’s also important that the agreement was entered into freely and that both parties understand the financial and legal implications of the prenup. Moreover, both parties should disclose all assets and property fully, receive legal advice and ensure the prenup is contractually valid.

Can you sign a prenup after marriage?

You cannot sign a prenup after marriage. The prenuptial agreement will need to be signed at least 28 days before the wedding with all individual and joint assets and property disclosed.

If you haven’t signed a prenup before marriage, that does not mean you can’t still protect your assets. If you and your partner are already married, you can sign a postnuptial agreement, otherwise known as a postnup.

A postnup is similar to a prenup – the only difference is that it’s a contract between couples who are already married rather than engaged to be married. Like a prenup, a postnup sets out how assets will be divided should the marriage end in divorce.

Note that postnups are also not legally binding, but will still hold weight in court as long as they are fair and do not prejudice any children.

How to get a prenup?

In order to get a prenup, you should seek the services of an experienced family law solicitor. At Bromfield Legal, we are specialists at drafting prenuptial agreements and work closely with you to tailor them to your specific needs and make sure your assets are set out clearly and fairly.

Looking to speak to an expert? Contact us today to find out how we can help you protect your family’s financial future. We look forward to chatting with you soon!

We hope we’ve provided some clarity on what to know about prenuptial agreements. For more expert legal advice, visit our blog. We talk you through topics such as no-fault divorce, what happens when your spouse dies and you have a prenup and much more.

To learn more about the ins and outs of prenups, read our blog on what is a prenuptial agreement.